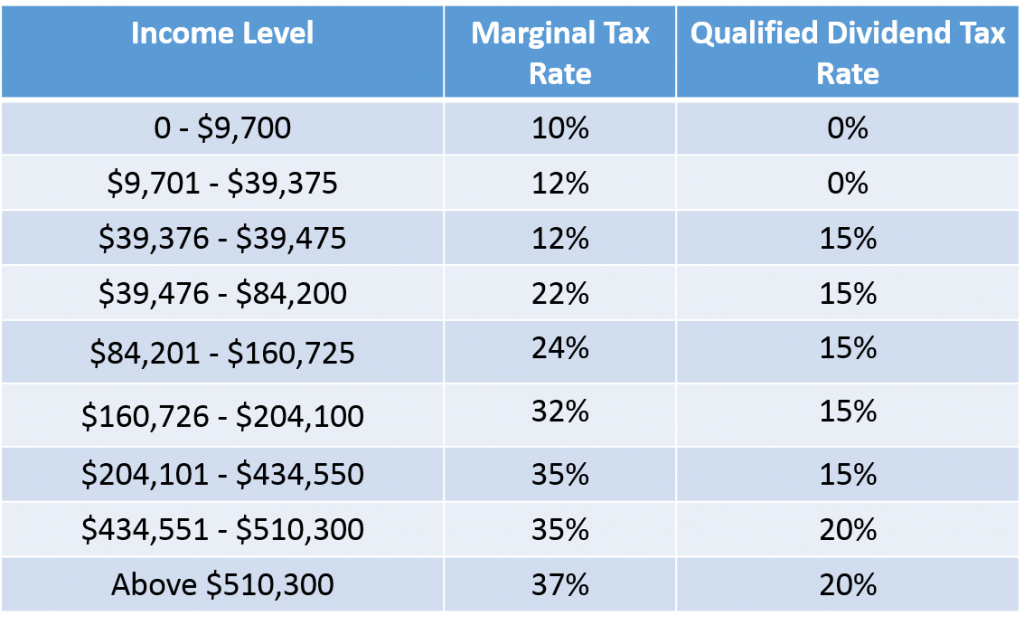

Tax Rates On Dividends 2025. Qualified dividend tax rates for 2025 and 2025. Dividend ordinary rate — for dividends otherwise taxable at the basic rate:

The next table presents the tax rates assessed on ordinary or nonqualified dividends in 2025, depending on your taxable income. How much of your income falls within each tax band;

How To Avoid Short Term Capital Gains Treatbeyond2, Higher tax brackets will pay 15% or 20%. 2025 taxable income(1) canada 2025 marginal tax rates:

ShortTerm And LongTerm Capital Gains Tax Rates By The News Intel, These rates are influenced by your tax bracket , which is determined. The current tax year is from 6 april 2025 to 5 april 2025.

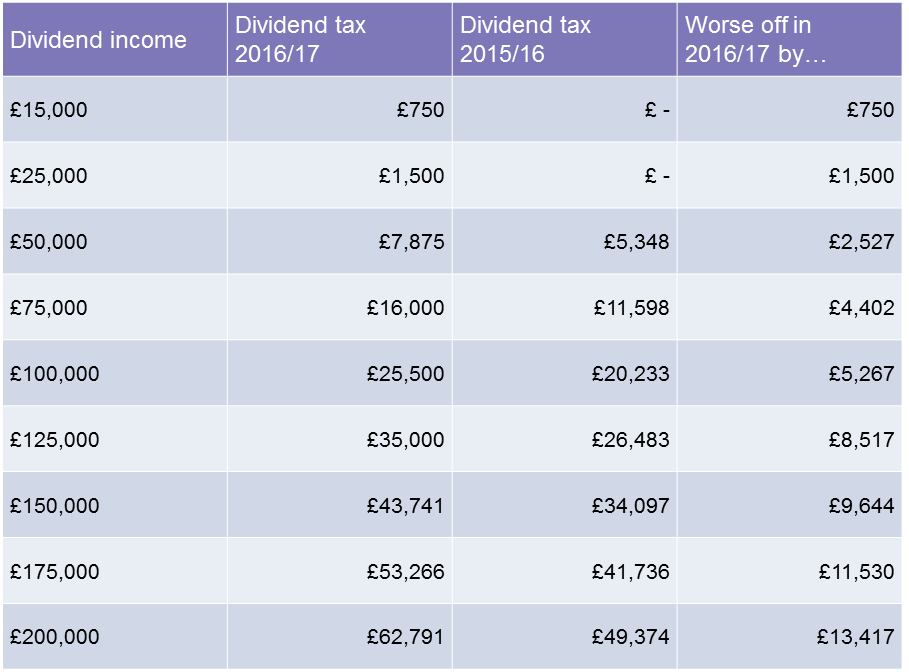

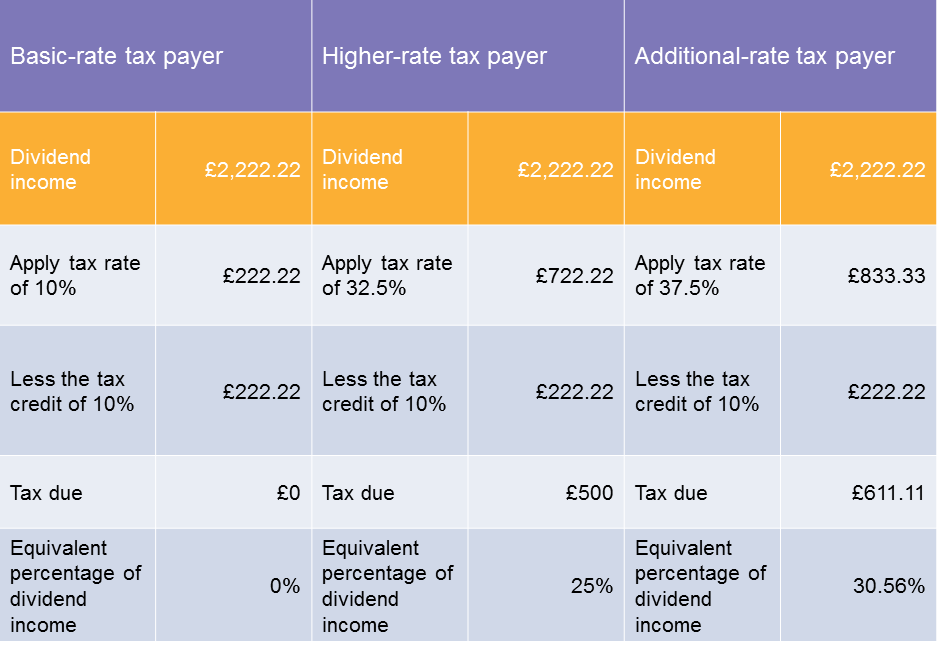

Beware! Your dividend tax rate is changing, here's what you need to know, Higher rate band (over £50,270) the rest of john’s dividends fall into the higher rate band. However, unlike income tax rates, only three rates exist for.

Dividend Withholding Tax Rates by Country for 2025, The current tax year is from 6 april 2025 to 5 april 2025. Around 46% of those with taxable dividend income will be unaffected by this measure in the year 2025 to 2025, falling to 27% in the year 2025 to 2025.

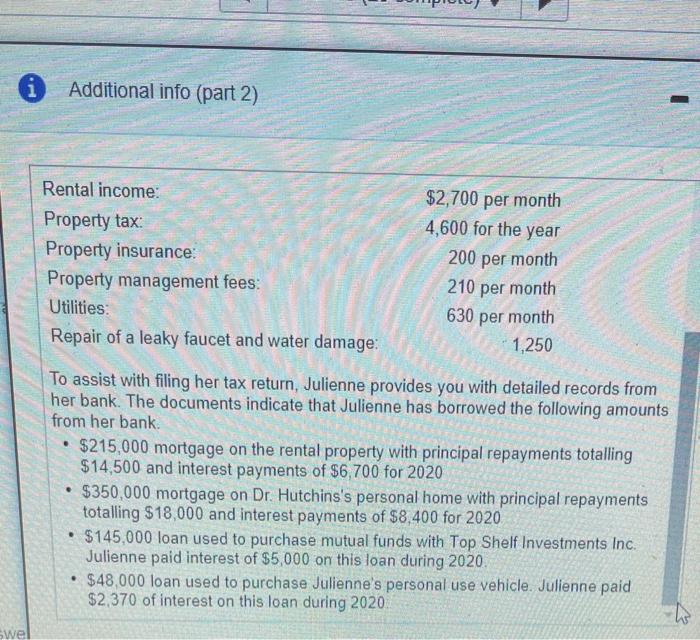

Solved Item Dividends from public Canadian corporations, Higher rate band (over £50,270) the rest of john’s dividends fall into the higher rate band. Tax on dividends in basic rate band:

Changing the Tax Rates within an Invoice or Proposal, 2025 taxable income(1) canada 2025 marginal tax rates: What are the 2025 tax rates for dividends in different tax brackets?

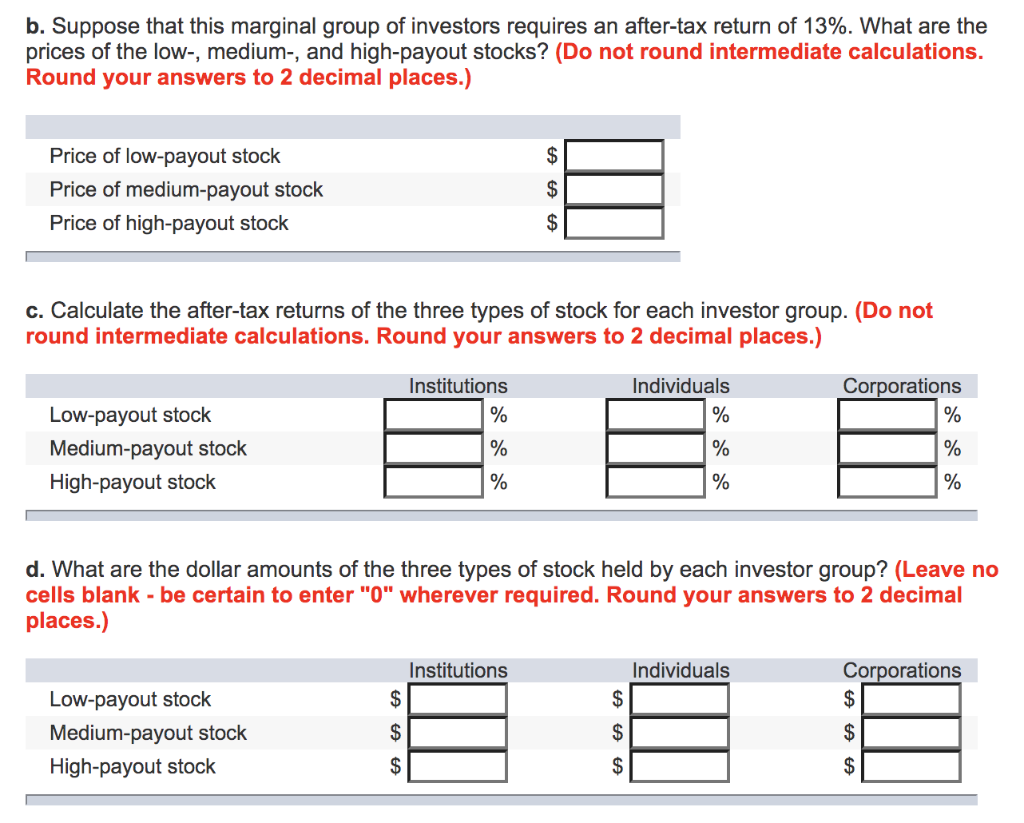

Solved Suppose that there are just three types of investors, What are the qualified dividend tax rates? This amount is in addition to your personal income tax.

Tax Basics WES, See current federal tax brackets and rates based on your income and filing status. The current tax year is from 6 april 2025 to 5 april 2025.

Beware! Your dividend tax rate is changing, here's what you need to know, Page last reviewed or updated: The qualified dividend tax rate for 2025 is 0% for individuals making $47,025 or less.

Changes to the 2018/19 Allowances, Exemptions and Tax Rates Taxback, 47% — over £125,141 — — top rate for tax years up to and. These rates are influenced by your tax bracket , which is determined.

Before delving into the roles of a tax accountant, it’s crucial to grasp the basics of dividend taxation in the uk.

Gerard Way Interview 2025. Gerard way on dc comics' young animal imprint, his musical detour […]

Richmond Top Doctors 2025. Ophthalmology published december 30, 2025 by virginia business dr. Sentara internal […]