Ira Limits 2025 Tax Deduction. For 2025, the total contribution limit of your iras, roth or traditional, is no more than $7,000 ($8,000 if you’re 50 or older). Find out if your modified adjusted gross income (agi ) affects your roth ira contributions.

The ira contribution limits for 2025 are $7,000 for those under age 50, and $8,000 for those age 50 or older. The roth ira contribution limit for 2025 is $7,000 for those under 50, and $8,000 for those 50 and older.

The IRS announced its Roth IRA limits for 2025 Personal, This table shows whether your contribution to a roth ira is affected by the.

Maximum Home Office Deduction 2025 Irs Vanya Jeanelle, The ira contribution limit is $7,000, or $8,000 for individuals 50 or older in 2025.

401k Contribution Limits For 2025 Over 50 Gisele Gabriela, The ira contribution limits for 2025 are $7,000 for those under age 50, and $8,000 for those age 50 or older.

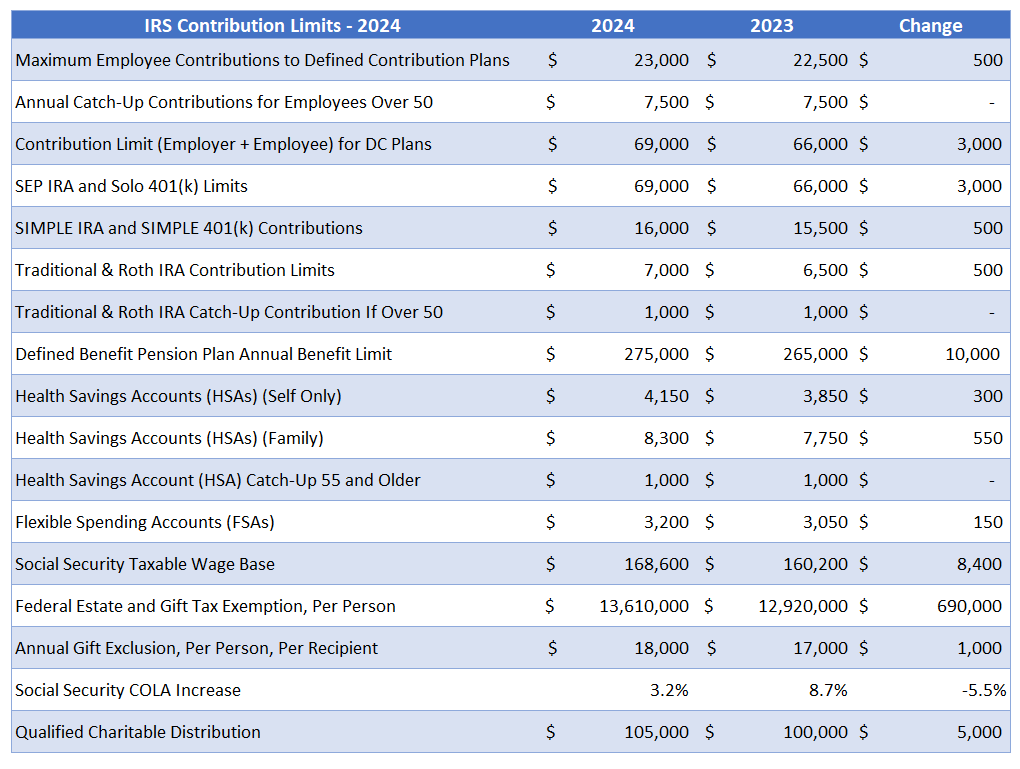

2025 Contribution Limits Announced by the IRS, The maximum total annual contribution for all your iras (traditional and roth) combined is:

Catch Up Contributions For Simple Ira 2025 Sasha Costanza, Higher contribution limits for 401(k)s,.

Roth Contribution Limits For 2025 Emyle Francene, The table below details the limits for tax years 2025 and 2025.

2025 IRS Contribution Limits For IRAs, 401(k)s & Tax Brackets, A partial deduction is available for incomes between $73,000 and $83,000.

Ira Limits 2025 For Deduction Donnie Margaux, The table below shows the aggregate contribution limits for these two accounts by tax year for the past.

Ira Limits 2025 For Deduction Donnie Margaux, The ira contribution limits for 2025 are $7,000 for those under age 50, and $8,000 for those age 50 or older.

Coverdell Ira Contribution Limits 2025 Inge Regine, A partial deduction is available for incomes between $73,000 and $83,000.